The adoption of proof of stake over proof of work protocol has introduced the concept of staking in the cryptocurrency world. Staking allows anyone to contribute to the security of a blockchain and to earn rewards in exchange for putting their crypto to work.

More generally, staking in DeFi refers to the process of locking up a cryptocurrency to contribute to the network's security, validation, and governance. It is a way for users to earn rewards while helping to secure the network. In protocols like OHM or Klima, users can stake their tokens in exchange for yield or governance rights. When a user stakes their tokens, they lock them up in a smart contract, which holds the funds until the staking period ends.

During this period, the user may receive rewards in the form of tokens or fees. The rewards vary depending on the protocol and can be a fixed rate or a variable rate based on market conditions. Additionally, staking can provide governance rights, allowing users to participate in the decision-making process of the network. In this case, stakers can vote on proposals or changes to the protocol, helping to shape its direction.

Overall, staking in DeFi protocols like OHM or Klima can be a profitable way to earn passive income and have a say in the network's governance.

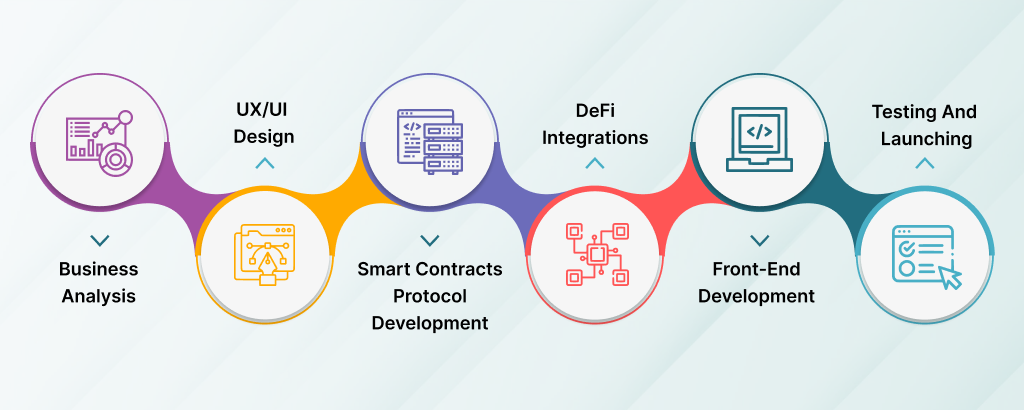

(For further info, see https://www.raininfotech.in/blogs/how-to-build-a-defi-staking-platform/, where the following image is retrieved).

Coinbase offers staking services to its users, and its core staking service is not a security.

While anyone can participate in staking activities, the average crypto user will generally use a service provider like Coinbase to keep the servers running and software up to date.

Staking is not a security under the US Securities Act, nor under the Howey test. Staking fails to meet the four elements of the Howey test: investment of money, common enterprise, reasonable expectation of profits, and efforts of others.

The purpose of securities law is to correct for imbalances in information, but there is no imbalance of information in staking as all participants are connected on the blockchain and have equal access to the same information.

Coinbase's staking services may not be considered securities for several reasons:

- Staking is not an investment contract: Staking involves holding and locking up cryptocurrency to help validate transactions on a blockchain network. Unlike traditional investments, staking does not involve buying securities or expecting a return on investment based on the efforts of others.

- Staking rewards are not guaranteed: The rewards from staking are not guaranteed and can fluctuate depending on the performance of the blockchain network. This means that staking is not considered a fixed income security.

- Staking is not marketed as a security: Coinbase markets its staking services as a way for customers to earn rewards by helping to secure the blockchain network. It does not market these services as investments or securities.

However, it's important to note that the classification of staking services as securities can be a complex legal question and may depend on various factors such as the specific nature of the staking arrangement and the jurisdiction in which it is offered. Therefore, it is possible that the classification of staking services as securities could change in the future as regulators continue to evaluate the cryptocurrency market.